Debt

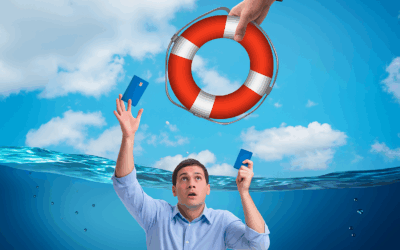

Drowning in Bills? These Debt Solutions Could Be the Break You Need

Drowning in Bills? These Debt Solutions Could Be the Break You Need Across the country, families are tightening their belts and rethinking how they spend every dollar to pay their bills. With prices climbing and paychecks stretched thin, more Americans are realizing that traditional budget or debt advice — “skip the coffee” or “cut streaming services” — just isn’t enough. Real people need real solutions that make a real difference. From consolidating debt to reducing unnecessary interest and negotiating smarter repayment plans, there are now practical tools designed to help everyday individuals find relief without taking on new financial risks. These programs focus on one goal: making your money work for you, not against you. Budgeting isn’t just about cutting back — it’s about regaining control. Whether that means combining multiple bills into one manageable payment, trimming high-interest balances, or finally getting a clear picture of where your money goes each month, small, strategic changes can have a big impact over time. Financial stress can be overwhelming, but it doesn’t have to be permanent. More and more Americans are discovering proven ways to simplify their finances, lower monthly costs, and start building toward stability again — one step, one payment, one plan at a time. 1. Feeling Crushed by Credit Card Debt? This Simple Program Could Help If your paycheck isn’t stretching as far as it used to, you’re not alone. From groceries to gas to housing, rising costs are putting real pressure on the family budget nationwide. Many are dipping into savings, maxing out credit cards, or delaying bills just to make ends meet. But more and more Americans are discovering a new way to find relief — one that helps reduce debt, simplify payments, and ease financial stress without taking on new loans. It’s called debt consolidation, and it’s helping people regain control of their finances faster than they thought possible. These debt consolidation programs connect consumers with trained specialists who work directly with creditors. They negotiate lower balances on unsecured debts such as credit cards or medical bills. Instead of juggling multiple payments, participants make one manageable monthly deposit while experts handle the rest. (MORE NEWS: Should You Refinance Your Mortgage After Fed Rate Cuts?) Here’s what makes debt consolidation programs stand out: You could reduce your total debt by negotiating lower payoff amounts. No new loans — just a structured plan to help regain control of your budget. One monthly payment replaces multiple bills. Professional negotiators handle creditor calls and settlements. Many see substantial progress within months, with complete resolutions typically in 2–4 years. It’s not an instant fix, and credit scores may dip temporarily. But for thousands, debt consolidation offers a realistic path away from endless minimum payments and toward lasting financial stability. If you’ve been feeling the squeeze, now’s the time to act. See how Americans are finally finding financial breathing room — and how you can too! See If You Qualify 2. Seniors Are Saving Big — Get Full Coverage Car Insurance for Pennies on the Dollar! Many seniors are shocked to learn they could be paying far less for the same auto insurance coverage. If you’ve had a clean driving record or simply haven’t compared rates in a while, you might be missing out on major savings. Recent programs have made it easier than ever for drivers over 55 to qualify for exclusive senior auto insurance discounts — often cutting premiums dramatically. Some are finding ways to pay pennies on the dollar compared to what they used to spend, while still enjoying full coverage protection and dependable service. These discounts aren’t always advertised, but checking your eligibility only takes a minute. By comparing trusted providers, you can quickly see how much you could save — no hidden fees, no obligation. Find out if you qualify for full coverage car insurance for pennies on the dollar — and start saving today! Compare Rates Now 3. Finding Relief: Real Debt Relief Options Helping Americans Reclaim Control For millions of Americans, debt has become more than a number on a statement — it’s a source of constant stress that affects every part of life. Between rising prices, unexpected expenses, and interest rates that seem to climb overnight, many households are struggling to stay ahead. But now, a growing number of people are discovering real debt relief options that can finally make a difference. Unlike traditional loans or credit counseling, modern debt relief programs focus on helping you reduce what you owe — not just shuffle it around. These programs connect you with experts who negotiate directly with creditors to settle accounts for less than the full balance, often saving participants thousands. The goal is simple: to create a manageable path toward financial stability, without taking on new debt. Here’s what makes debt relief programs stand out: You could cut down your total debt by negotiating lower settlements. No new loans or long-term contracts to worry about. One affordable monthly deposit replaces multiple bills. Professionals handle creditor calls and negotiations on your behalf. Many participants become debt-free within 2–4 years, depending on their situation. It’s not a one-size-fits-all solution — and it’s not instant — but for thousands of Americans, debt relief offers a fresh start after years of financial stress. If you’re feeling buried by bills and high interest rates, there’s a way forward. Explore today’s debt relief options and see how you can finally get ahead! Get Relief While It’s Available #4 Medicare Open Enrollment: How Seniors Are Saving on Healthcare Costs Healthcare can quickly become one of the biggest expenses in retirement — but it doesn’t have to be. During Medicare Open Enrollment, seniors have a valuable chance to review and update their plans, often unlocking better coverage and lower costs. Many Americans over 65 don’t realize they could qualify for extra benefits, like vision, dental, hearing, and prescription coverage, all while reducing premiums. Comparing plans now could save hundreds — or even thousands — of dollars each year. Here’s why reviewing your Medicare options…

Feeling a Financial Squeeze? How to Find Relief Now

Right now, many households are feeling the financial pinch. The economy remains unsettled, layoffs continue across industries, and the number of open jobs is lower than before. At the same time, the cost of living keeps climbing. Groceries, rent, and everyday expenses have all gone up. Credit card balances are rising, and many families are using debt to make ends meet. This combination has created real financial pressure. Even people who have always paid their bills on time are struggling to keep up. While things are expected to improve in the future, the truth is we are going through a tight squeeze right now. If you find yourself buried under bills or unsure how to move forward, you are not alone. The good news is that help is available. There are ways to manage your debt, reduce financial stress, and begin rebuilding stability. Here’s what you need to know. Understanding Debt-Relief Services Debt-relief services are designed to help people who can’t keep up with unsecured debts, such as credit cards or medical bills. These programs negotiate with your creditors to lower the total amount you owe. Instead of paying your full balance, you may be able to settle for a smaller lump sum. (MORE NEWS: Retirement 2025: America’s Safest and Wealthiest Towns to Call Home) The process usually works like this: You stop making direct payments to your creditors. You deposit money each month into a special account. Once that account builds up enough funds, the company negotiates a settlement on your behalf. When an agreement is reached, your debt is marked as resolved after you pay the negotiated amount. These programs often take two to four years to complete. While they can reduce what you owe, they also require patience and consistency. Why More People Are Turning to Debt Relief In times of financial strain, more people consider debt-relief options. With prices up and incomes stretched, credit card use has surged. Interest rates a high been much higher since 2022, making it harder to pay off balances. The average credit card interest rate was 21.39% in August 2025, according the Federal Reserve. For many, debt-relief services provide structure and support. They can simplify payments and help reduce stress. Instead of facing several creditors, you work through one program that manages negotiations for you. Debt relief can also be an alternative to bankruptcy. For people who want to avoid that step, settlement programs offer a middle ground — a way to regain control without starting over completely. The Benefits of Working with a Debt-Relief Program Reduced balances: Creditors may agree to settle for less than what you owe. Simplified payments: You deposit one monthly amount instead of juggling multiple bills. Faster results: In some cases, people become debt-free in just a few years. Peace of mind: Having professionals handle negotiations can relieve stress during a difficult time. While it won’t fix everything overnight, this approach can give you a clear plan and a light at the end of the tunnel. Risks You Should Understand Debt relief isn’t a magic solution. There are trade-offs. Because you stop paying your creditors during negotiations, your credit score will likely drop. It can take time to rebuild it afterward. There is also no guarantee that every creditor will agree to settle. If they refuse, you could still owe the full balance. Additionally, forgiven debt may be considered taxable income, so it’s important to plan for that possibility. (MORE NEWS: Government Shutdown Stalls Real Estate in 5 States) Finally, not all companies operate honestly. Some charge high upfront fees or make promises they can’t keep. Always research thoroughly, check reviews, and make sure a company only charges after they’ve successfully settled your debt. Signs Debt Relief Might Be Right for You You have large unsecured debts you can’t manage under current terms. You’ve tried credit counseling, consolidation, or budgeting without success. You can make regular deposits into a settlement account for several years. You are willing to accept a temporary hit to your credit in exchange for long-term freedom. If those points describe your situation, talking to a reputable professional could be the next smart step. Other Ways to Find Relief Debt relief is only one option. You can also explore other paths: Debt consolidation: Combine several high-interest debts into one lower-rate loan. Credit-counseling programs: Work with nonprofit counselors who negotiate lower interest rates and help you create a manageable payment plan. Budget adjustments: Track spending closely, cut unnecessary expenses, and focus on essentials until prices stabilize. Side income or part-time work: Even temporary income can help you stay afloat and avoid deeper debt. Bankruptcy: As a last resort, bankruptcy can offer a clean slate, but it carries serious long-term effects. Tips for Getting Through This Moment If you’re struggling right now, remember that many people are in the same boat. Here are practical steps to make things a little easier: Track every dollar. Write down what comes in and what goes out each month. Cut unnecessary spending. Cancel unused subscriptions and reduce impulse purchases. Negotiate your bills. Some creditors will lower rates or extend deadlines if you ask. Focus on essentials. Prioritize food, housing, and transportation over unsecured debts. Build an emergency fund. Even small amounts add up over time. Ask for help early. Don’t wait until you’re behind — contact support programs before accounts go into default. A Hopeful Outlook The current economic challenges — job uncertainty, rising costs, and growing debt — are real. But they won’t last forever. Economic cycles always shift. Opportunities will return, wages will rise, and the cost of living will eventually stabilize. In the meantime, taking control of your finances is the best way to protect yourself. Whether you choose debt relief, consolidation, or budgeting adjustments, what matters most is that you take action. You are not alone, and things will improve. By learning about your options and making thoughtful choices today, you can build a stronger financial future tomorrow. Forget the narrative. Reject the script. Share what…

Should You Refinance Your Mortgage After Fed Rate Cuts?

With recent rate cuts and the likelihood of more to come, many homeowners are asking: Should I refinance my home? Refinancing can lower monthly payments, reduce interest over time, or help you pay off your mortgage sooner. However, the decision isn’t always simple. Here are the key points to consider, how to decide, and steps to get the best deal. Does Refinancing Make Sense? Recent interest rate cuts have created favorable conditions for refinancing. The Federal Reserve approved a widely anticipated rate cut. It indicated that two more cuts could be coming before the end of the year, according to CNBC. In an 11-to-1 vote, the Federal Open Market Committee lowered its benchmark overnight lending rate by a quarter percentage point, putting the overnight funds rate in a range between 4.00% and 4.25%. This is far from the best we’ve seen in the last decade, but with additional cuts, the rate could soon be closer to historic lows, creating an ideal window for homeowners to refinance. (RELATED NEWS: Protect Your Home Like Family: Smart Budgeting Tips) Homeowners who previously locked in higher rates could save significantly by refinancing today. Short-term and long-term mortgage rates may vary, but lenders often offer especially attractive terms for fixed-rate refinances. If your credit has improved or your home has increased in value, you might now qualify for better refinancing offers than in the past. Is There an Advantage to Staying with Your Current Lender? For many, staying with their current mortgage lender seems the easiest option. Convenience is a strong advantage. You already know the paperwork, process, and the people. You may avoid setting up new escrow accounts or dealing with new underwriters. Many lenders also offer retention incentives such as special rates, waived fees, or loyalty discounts to keep you as a customer. Refinancing with your existing lender can also be a faster process. Since they already hold your mortgage, internal transfers of information may reduce the documentation and verification steps required. As a result, your refinance could close more quickly than if you switched lenders. Potential Drawbacks of Not Shopping Around Convenience can come at a cost. Your current lender might not offer the lowest rate or best terms. They may assume you prefer to stay and therefore may not be as aggressive as new lenders who are trying to win your business. Additionally, fees and closing costs may still apply. Some lenders charge extra fees for new refinances, and sticking with your current lender could mean accepting higher costs or less favorable loan terms. Even small differences in rates or terms can add up to thousands of dollars over the life of your mortgage. Failing to compare offers could cost you more than the effort saved. Key Steps to Make the Best Refinance Decision Gather multiple offers: Get at least three quotes from different lenders to compare interest rates, closing costs, points, fees, and loan terms. Check your credit score and finances: A higher credit score or lower debt could qualify you for better rates. Stable income and solid home equity will strengthen your application. Compare loan terms: Shorter-term loans often have lower rates but higher monthly payments, while longer terms lower monthly payments but may cost more in interest over time. Calculate the break-even point: Determine how long it will take for the savings from a lower rate to outweigh the costs of refinancing. If you plan to move before then, refinancing may not be worth it. (RELATED NEWS: Gen Z Credit Scores Drop, But Future Looks Bright) Negotiate with your current lender: Show them competing offers. Lenders often match or beat better rates to retain existing customers, sometimes lowering fees or offering perks. Making a Lender Decision By the time you’ve gathered quotes and compared terms, the choice often becomes clear. If your current lender offers a competitive rate and low fees, the simpler process might tip the scales in their favor. If another lender’s offer means real long-term savings or better terms, switching is worth the extra paperwork. Focus on which option saves you the most money over time and fits your financial goals. Final Thoughts: Lock In or Wait With the Federal Reserve cutting rates and signaling more reductions ahead, homeowners face an important decision. Refinancing now could lock in lower payments and protect against future rate increases. Some borrowers may benefit from acting immediately, especially if a lender offers terms that align with long-term goals and meaningful savings compared to their current loan. Others might wait, as the Fed’s anticipated cuts later this year could push rates even lower. Waiting is an option if your current rate is manageable and you can tolerate some uncertainty. Remember, mortgage rates don’t always move in step with the Fed. Global events, bond market demand, and inflation trends can all influence rates. The best approach is to be prepared: gather quotes, know your break-even point, and keep your finances ready. Whether you refinance now, switch lenders, or wait for potential lower rates, choose the option that fits your budget, timeline, and financial goals. Expose the Spin. Shatter the Narrative. Speak the Truth. At The Modern Memo, we don’t cover politics to play referee — we swing a machete through the spin, the double-speak, and the partisan theater. While the media protects the powerful and buries the backlash, we dig it up and drag it into the light. If you’re tired of rigged narratives, selective outrage, and leaders who serve themselves, not you — then share this. Expose the corruption. Challenge the agenda. Because if we don’t fight for the truth, no one will. And that fight starts with you.