With recent rate cuts and the likelihood of more to come, many homeowners are asking: Should I refinance my home? Refinancing can lower monthly payments, reduce interest over time, or help you pay off your mortgage sooner. However, the decision isn’t always simple. Here are the key points to consider, how to decide, and steps to get the best deal.

Does Refinancing Make Sense?

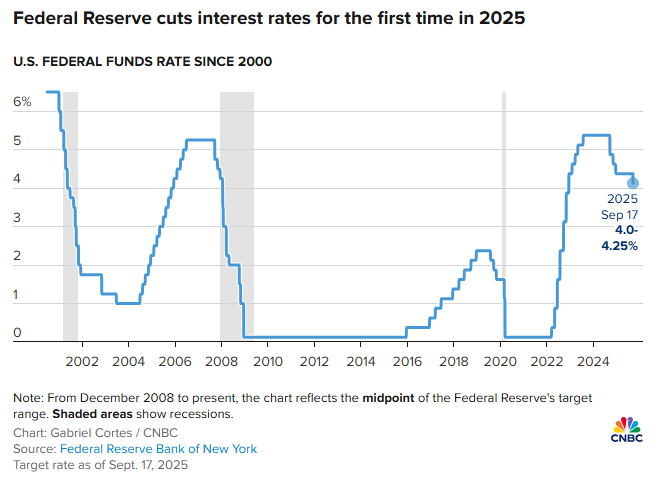

Recent interest rate cuts have created favorable conditions for refinancing. The Federal Reserve approved a widely anticipated rate cut. It indicated that two more cuts could be coming before the end of the year, according to CNBC. In an 11-to-1 vote, the Federal Open Market Committee lowered its benchmark overnight lending rate by a quarter percentage point, putting the overnight funds rate in a range between 4.00% and 4.25%. This is far from the best we’ve seen in the last decade, but with additional cuts, the rate could soon be closer to historic lows, creating an ideal window for homeowners to refinance. (RELATED NEWS: Protect Your Home Like Family: Smart Budgeting Tips)

Homeowners who previously locked in higher rates could save significantly by refinancing today. Short-term and long-term mortgage rates may vary, but lenders often offer especially attractive terms for fixed-rate refinances. If your credit has improved or your home has increased in value, you might now qualify for better refinancing offers than in the past.

Is There an Advantage to Staying with Your Current Lender?

For many, staying with their current mortgage lender seems the easiest option. Convenience is a strong advantage. You already know the paperwork, process, and the people. You may avoid setting up new escrow accounts or dealing with new underwriters. Many lenders also offer retention incentives such as special rates, waived fees, or loyalty discounts to keep you as a customer. Refinancing with your existing lender can also be a faster process. Since they already hold your mortgage, internal transfers of information may reduce the documentation and verification steps required. As a result, your refinance could close more quickly than if you switched lenders.

Potential Drawbacks of Not Shopping Around

Convenience can come at a cost. Your current lender might not offer the lowest rate or best terms. They may assume you prefer to stay and therefore may not be as aggressive as new lenders who are trying to win your business. Additionally, fees and closing costs may still apply. Some lenders charge extra fees for new refinances, and sticking with your current lender could mean accepting higher costs or less favorable loan terms. Even small differences in rates or terms can add up to thousands of dollars over the life of your mortgage. Failing to compare offers could cost you more than the effort saved.

Key Steps to Make the Best Refinance Decision

- Gather multiple offers: Get at least three quotes from different lenders to compare interest rates, closing costs, points, fees, and loan terms.

- Check your credit score and finances: A higher credit score or lower debt could qualify you for better rates. Stable income and solid home equity will strengthen your application.

- Compare loan terms: Shorter-term loans often have lower rates but higher monthly payments, while longer terms lower monthly payments but may cost more in interest over time.

- Calculate the break-even point: Determine how long it will take for the savings from a lower rate to outweigh the costs of refinancing. If you plan to move before then, refinancing may not be worth it. (RELATED NEWS: Gen Z Credit Scores Drop, But Future Looks Bright)

- Negotiate with your current lender: Show them competing offers. Lenders often match or beat better rates to retain existing customers, sometimes lowering fees or offering perks.

Making a Lender Decision

By the time you’ve gathered quotes and compared terms, the choice often becomes clear. If your current lender offers a competitive rate and low fees, the simpler process might tip the scales in their favor. If another lender’s offer means real long-term savings or better terms, switching is worth the extra paperwork. Focus on which option saves you the most money over time and fits your financial goals.

Final Thoughts: Lock In or Wait

With the Federal Reserve cutting rates and signaling more reductions ahead, homeowners face an important decision. Refinancing now could lock in lower payments and protect against future rate increases.

Some borrowers may benefit from acting immediately, especially if a lender offers terms that align with long-term goals and meaningful savings compared to their current loan. Others might wait, as the Fed’s anticipated cuts later this year could push rates even lower. Waiting is an option if your current rate is manageable and you can tolerate some uncertainty.

Remember, mortgage rates don’t always move in step with the Fed. Global events, bond market demand, and inflation trends can all influence rates.

The best approach is to be prepared: gather quotes, know your break-even point, and keep your finances ready. Whether you refinance now, switch lenders, or wait for potential lower rates, choose the option that fits your budget, timeline, and financial goals.

Expose the Spin. Shatter the Narrative. Speak the Truth.

At The Modern Memo, we don’t cover politics to play referee — we swing a machete through the spin, the double-speak, and the partisan theater.

While the media protects the powerful and buries the backlash, we dig it up and drag it into the light.

If you’re tired of rigged narratives, selective outrage, and leaders who serve themselves, not you — then share this.

Expose the corruption. Challenge the agenda.

Because if we don’t fight for the truth, no one will. And that fight starts with you.