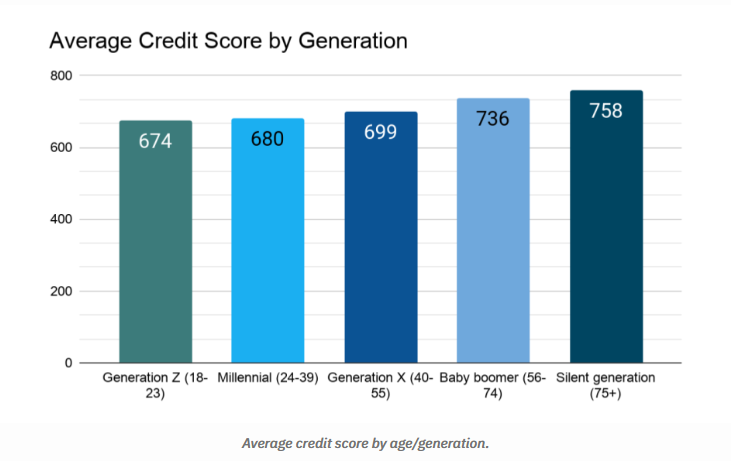

FICO released their annual FICO Score Credit Insights Report and Gen Z has seen its credit scores fall more than any other generation over the past year. The average FICO score for all U.S. consumers dropped two points to 715. For Gen Z, the decline was three points, bringing their average to 676 — the largest year-over-year decrease for any age group since 2020.

Insights From FICO: Gen Z Is Leading in Financial Health, Too

Despite the drop in scores, Gen Z is showing unusual engagement with their financial health. According to FICO’s “Financial Health Revolution: How Gen Z Is Leading the Charge,” Gen Z and Millennials check their credit scores monthly at about one and a half times the rate of older generations.

The same report finds that among Gen Z and Millennial consumers, 44% and 45% respectively report credit score improvements over the past six months, suggesting the trend is already turning upward.

Gen Z also often uses credit strategically. When income dropped or unexpected expenses came, about half of this age group used credit cards or Buy Now, Pay Later loans to make ends meet.

Why Credit Scores Are Declining

Several factors contribute to the decline for Gen Z. Student loan debt plays a major role. About one-third of these borrowers have active student loans, which is roughly double the rate for the overall population. (RELATED NEWS: Skipping Coverage: The New Trend Among Young Adults)

Delinquency reporting for student loans resumed recently. During the COVID-19 pandemic, payments were paused. Now that collections have restarted, late or missed payments are appearing on credit reports again.

Economic pressures hit the young generation especially hard. Inflation, high housing and living costs, and a tougher job market make it harder for many in this age bracket to stay current on bills.

What This Means

Lower credit scores can make daily financial life harder. It may cost more or be harder to get approved for car loans, mortgages, or credit cards. Higher interest rates or fees can result from weaker scores. Insurance rates, rental applications, and other services sometimes depend on credit strength. (MORE NEWS: AI Is Taking Entry-Level Jobs and Shaking Up the Workforce)

At the same time, FICO’s report shows that Gen Z is not passive. Their frequent credit score checks and willingness to take steps to build financial health suggest potential for recovery.

Steps Gen Z Can Take to Improve Their Credit Scores

Even with these challenges, there are clear actions that can help:

- Check your credit score regularly so you know where you stand.

- Pay bills on time. Even the minimum payment helps; late payments hurt credit a lot.

- Set up automatic payments to avoid forgetting due dates.

- Keep your credit utilization low — aim to use a modest portion of your available credit.

- Avoid taking on unnecessary new debt, especially if you already have student loans or variable expenses.

Because this group is already engaging with financial tools more often, these habits can build up sooner.

The Bright Side: Gen Z’s Recovery Potential

Ultimately, Gen Z has something many generations do not: high levels of awareness about credit health. FICO reports that they treat credit scores like a fitness tracker — checking them often, making improvements, and using credit tools as financial safety nets when needed.

Even though their scores have dropped, many in this group are reporting improvements in the past few months. Small but consistent efforts can make a real difference.

Final Thoughts

Headlines focus on falling scores, but there’s another side to the story. Gen Z is changing how people manage money. They use apps, track spending in real time, and share money tips with friends online. Credit scores matter, but they are only part of the bigger picture.

What makes Gen Z different is their awareness and adaptability. They don’t ignore money problems — they try things, learn fast, and adjust. With that kind of energy, this generation has the potential to become one of the most financially resilient yet.

Forget the narrative. Reject the script. Share what matters.

At The Modern Memo, we call it like it is — no filter, no apology, no corporate leash.

If you’re tired of being lied to, manipulated, or ignored, amplify the truth.

One share at a time, we dismantle the media machine — with facts, boldness, and zero fear. Stand with us. Speak louder.