Imagine getting into a fender-bender on the way to work, only to discover the other driver is uninsured. Suddenly, you’re not just late for a meeting, you’re staring down thousands of dollars in bills.

Replacing a bumper today costs more than some used cars did a decade ago. And a single ER visit can run higher than your monthly mortgage. That’s why the latest study showing one in three drivers lack enough insurance should make everyone pay attention.

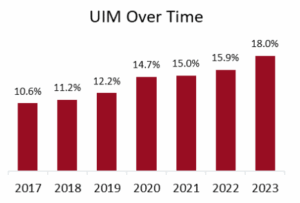

A 2025 report from the Insurance Research Council (IRC) reveals that more than one in three drivers in the United States were either uninsured or underinsured in 2023. The study, Uninsured and Underinsured Motorists: 2017–2023, shows the combined rate climbed to 33.4 percent, a sharp increase from 23.8 percent in 2017. This growing problem highlights the financial risks drivers face every time they get behind the wheel.

Breaking Down the Numbers

The IRC study provides a clear picture of how widespread the problem has become:

- 15.4 percent of drivers in 2023 carried no auto insurance at all.

- 18.0 percent of drivers carried insurance that failed to fully cover the costs of a serious accident.

- Together, uninsured and underinsured drivers accounted for more than one in three motorists nationwide.

The report explains, “Uninsured motorist and Underinsured motorist claim frequencies increased at faster rates than Bodily Injury claim frequency, leading to a sharp increase in the combined rate of uninsured and underinsured motorists.” In other words, accidents are costing more, and too many policies are falling short. (RELATED NEWS: Skipping Coverage: The New Trend Among Young Adults)

State-by-State Differences

The risk is not evenly spread across the country. According to the IRC, “Uninsured motorist rates varied dramatically by state in 2023, ranging from a low of 5.7 percent in Maine to a high of 28.2 percent in Mississippi.”

Insurance Information Institute reports:

- New Mexico had an uninsured rate of 24.1 percent, while the District of Columbia followed with 23.1 percent.

- On the lower end, Utah posted 6.2 percent, and Idaho recorded 6.4 percent.

- Underinsured motorist rates climbed in nearly every state between 2017 and 2023, with the only exceptions being New York and the District of Columbia.

This means drivers in certain regions face a much greater chance of being hit by someone without adequate insurance.

Why the Numbers Are Rising

Coverage reflects economic and legal factors at the time. The report notes that “UM rates rose in nearly every state from 2019 to 2020,” showing the strain of the pandemic on household budgets. Even as the economy improved, rates did not return to pre-pandemic levels.

Rising medical and repair costs push up claim amounts, and when policies fail to keep pace, the gap between coverage and actual costs grows wider.

Many states also set low minimum coverage requirements. Florida, for example, is the lowest in the country. The state only requires $10,000 property damage liability. These minimums are not enough to cover the expenses of a modern accident, leaving even insured drivers underinsured when serious injuries or major property damage occur.

The Risks for Fully Insured Drivers

Drivers who carry good insurance may think they are safe, but the study underscores the risk for everyone. If an uninsured or underinsured driver causes a crash, the other party often has to rely on their own coverage to pay for damages. Without uninsured or underinsured motorist protection, victims may face overwhelming medical bills, repair costs, and lost income.

The IRC warns that higher underinsured motorist rates can also “worsen affordability” for everyone, since insurers spread the rising costs across all policyholders. This means responsible drivers end up paying higher premiums as the pool of underinsured drivers grows. (MORE NEWS: United CEO Scott Kirby Says Spirit Airlines Will Collapse)

How Drivers Can Protect Themselves

The study makes it clear that every driver should take a closer look at their own coverage. Practical steps include:

- Review your policy to confirm you carry uninsured and underinsured motorist coverage.

- Raise liability limits above state minimums to guard against lawsuits and high-cost accidents.

- Consider collision and comprehensive coverage if your vehicle is valuable or still financed.

- Shop around for competitive rates, look for discounts, and adjust deductibles to keep premiums manageable.

Taking these measures ensures you are not left exposed when facing an at-fault driver who lacks enough insurance.

Final Word

The IRC’s findings send a clear warning: Drivers are often unprepared for tragedy. They take risks—not only with their own health and property, but everyone else’s too. They also leave themselves open to lawsuits if they are not full covered.

One mistake by an uninsured driver, or one decision to carry too little coverage, can alter the course of your life.

We’re all just one accident away from a financial mess. Don’t let someone else’s mistake ruin your life. Review your policy today, raise your limits if needed, and give yourself the peace of mind you deserve.

Forget the narrative. Reject the script. Share what matters.

At The Modern Memo, we call it like it is — no filter, no apology, no corporate leash.

If you’re tired of being lied to, manipulated, or ignored, amplify the truth.

One share at a time, we dismantle the media machine — with facts, boldness, and zero fear. Stand with us. Speak louder.