Read It or Leave It

Robert Kiyosaki’s Rich Dad, Poor Dad remains one of the most influential personal finance books ever written. It challenges the way we think about money, work, and financial freedom. Kiyosaki tells the story of growing up with two father figures—his biological “poor dad” and his best friend’s “rich dad.” Each taught him a completely different philosophy about money and success.

Two Philosophies of Money

The “poor dad,” Kiyosaki’s biological father, represents the traditional mindset of the poor and middle class. He believed in hard work, job security, and higher education as the only path to success. Though had a Ph.D. in education, yet he lived with fear of losing his job and focused on what he couldn’t afford. He avoided risk and trusted the idea that a good job with benefits was the ultimate safety net.

The “rich dad,” however, thought differently. He only had an eighth-grade education, but became one of Hawaii’s wealthiest businessmen. He didn’t ask if something could be done—he asked how it could be done. Instead of seeing limits, he searched for financial solutions and opportunities. He believed in taking risks, building businesses, and acquiring income-generating assets.

Key Lessons from Rich Dad, Poor Dad

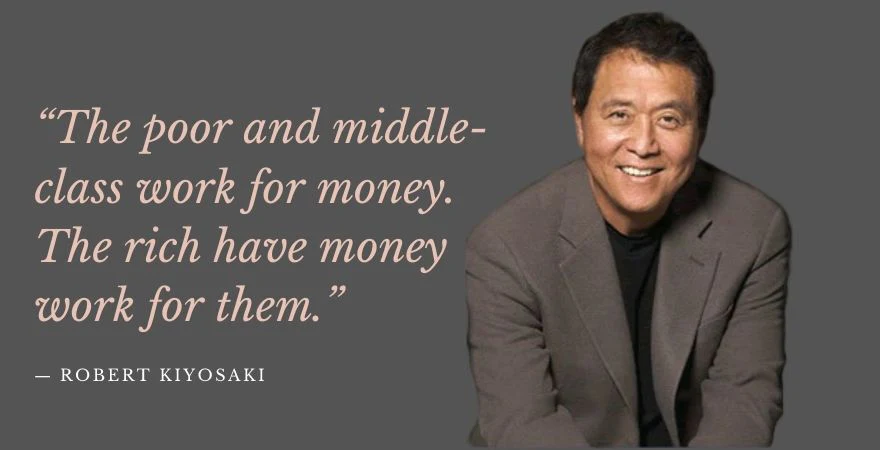

Kiyosaki and his friend learned firsthand from “rich dad.” He taught them the value of money by putting them to work, not by handing out cash. His focus was on financial literacy, passive income, and making money work for you instead of trading time for a paycheck. (RELATED NEWS: Back-to-School 2025: How Parents Are Spending)

One quote that stood out to me as helpful insight was:

“Keep your daytime job but start buying real assets. Not liabilities or personal effects that have no real value once you get them home. Keep expenses low, reduce liabilities, and diligently build a base of solid assets.”

This lesson lays the foundation of the book: it’s not about how much you earn, but about how much you keep and grow.

Kiyosaki drives this home with another insight:

“There is a difference between being poor and being broke. Being broke is temporary. Poor is eternal.”

That simple distinction shifts the mindset. Financial struggle is not inevitable; it’s tied to habits and decisions.

The Power of Assets vs. Liabilities

One of the most powerful takeaways from the book is understanding assets and liabilities. Kiyosaki explains:

“An asset puts money in your pocket. A liability takes money out of your pocket.”

This concept sounds simple, but it’s a game-changer. Many people think they own assets when they’re really buying liabilities—cars, gadgets, or even a house that drains cash without creating income.

Another helpful quote is:

“A person can be highly educated, professionally successful, but financially illiterate.”

Financial literacy, Kiyosaki argues, matters more than academic degrees when it comes to building lasting wealth. (RELATED NEWS: Catherine Zeta-Jones and the U.S. Homeownership Divide)

Quotes That Inspire Action

Throughout the book, Kiyosaki drops memorable one-liners that shift the way you think about money. These are some of the quotes that stood out:

- “So many people say, ‘Oh, I’m not interested in money.’ Yet they’ll work at a job for eight hours a day.”

- “Once you understand the difference between assets and liabilities, concentrate your efforts on buying income-generating assets.”

- “Wealth is a person’s ability to survive so many days forward – or, if I stopped working today, how long could I survive?”

- “Financial struggle is often directly the result of people working all their lives for someone else.”

- “Often in the real world, it’s not the smart who get ahead, but the bold.”

- “Simple math and common sense are all you need to do well financially.”

- “Most people never win because they’re afraid of losing, or failing.”

Each of these insights pushes readers to take control, think differently, and act boldly when it comes to money.

Why This Book Still Matters 28 Years Later

This is a book every young adult should read. Schools rarely teach financial literacy at the high school or college level. Rich Dad, Poor Dad fills that gap by teaching practical principles:

- Build multiple streams of income.

- Reduce liabilities and grow assets.

- Learn to invest in real estate, stocks, and businesses.

- Don’t just work for money—make money work for you.

As Kiyosaki points out, acquiring more money won’t help if you don’t know how to manage it. Money management, not just income, creates financial security.

Final Thoughts

Rich Dad, Poor Dad is more than a personal finance book—it’s a mindset shift. It helps the reader to stop thinking like a “poor dad” and start thinking like someone who has a strong financial future. It’s a challenge to step out of a comfort zone, to take healthy risks, and to reframe how money is viewed.

If you want to achieve financial freedom, change your mindset, and start building wealth, this book is a must-read. Keep it in your personal library and revisit it often. It’s an excellent guide for anyone ready to stop living paycheck-to-paycheck and start building a life of financial independence.

Definitely READ IT!

Beyond the Hype. Into the Truth.

At The Modern Memo, we don’t chase trends—we cut through them. The glossy marketing won’t tell you if a book is worth your time, but we will.

Tired of sugar-coated reviews and fake five-star ratings? We rip the cover off and get real about what’s inside. Honest reviews. No spin. No apologies.

Because readers deserve more than hype. They deserve the truth.